Inovatec LOS

Book the right deals more efficiently, expand your growth opportunities, and reduce your risk.

Use Cases

Direct financing

Indirect financing

Captive financing

From decisioning to funding, Inovatec LOS automates and streamlines the loan origination process.

Inovatec LOS is born in the cloud and fully optimized for indirect, direct, and captive financing. That’s why it’s become the secret weapon of leading lenders across Canada and the United States.

Automated Industry Best Practice Workflows

Automatic decisioning, drag-and-drop document management, and best-in-class funding workflow.

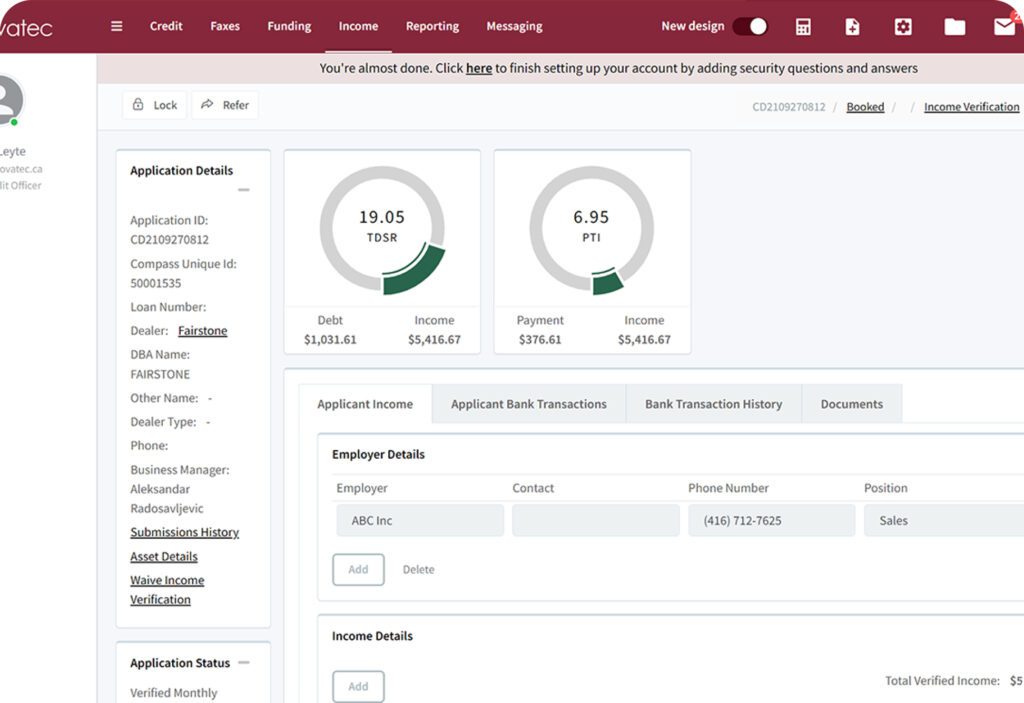

Modern User Interface

Intuitive interface with single-page view of all information required to decision an application.

Smart Configuration

Optimize workflows for your specific needs, and maintain full forward compatibility with new releases.

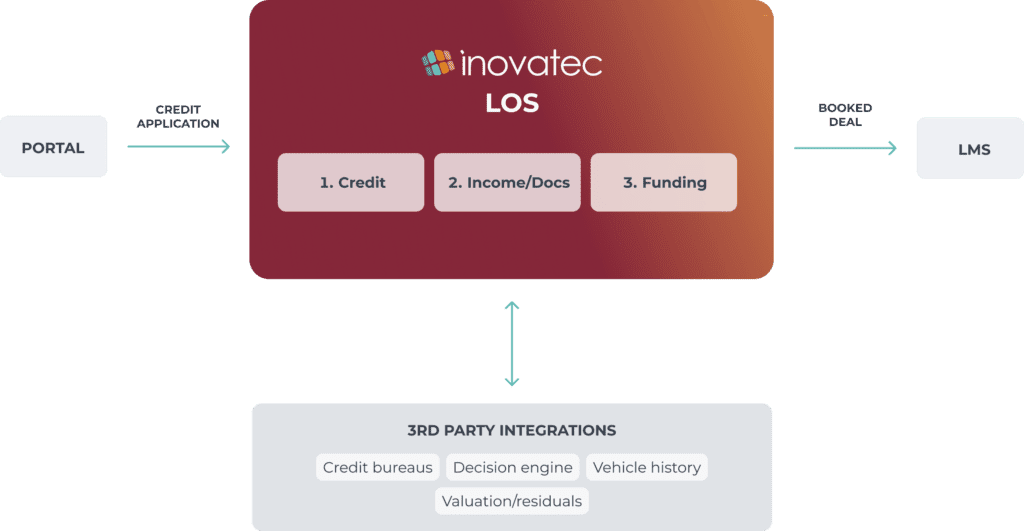

How Inovatec LOS Works

Inovatec LOS is fully automated, features best-in-class third-party integrations, and connects seamlessly with portals and loan servicing systems.

Explore integrations for each Inovatec LOS workflow

Click the workflow to see the associated integrations.

Credit Bureaus

Decision Engine

Fraud

Custom Bureau Attributes

Vehicle History

Consultative Services

Valuation/Residuals

Portal

Alternative Data

Identity Validation

Fraud

Income Verification

Compliance

Lien/Title Management

Communication

Documentation

E-Signature

Consultative Services

Leasing

Others

Why Inovatec LOS Leads the Industry

With a cloud-based architecture optimized for configurability, efficiency, and ease of use, it’s no wonder Inovatec LOS is driving the evolution of lending.

Born in the Cloud

Seamless deployment with no need for on-premises maintenance

No-Code Configuration

Easily configure workflows without having to file an IT ticket

Forward Compatibility

Your configurations migrate seamlessly to new versions of Inovatec LOS

Easy to Use

Faster onboarding and reduced need for IT support

Real-time Reporting

Get reports when you need them, with no queuing or waiting

Single-Tenant Services

Consistently high performance, security and reliability with no restrictions on resource use

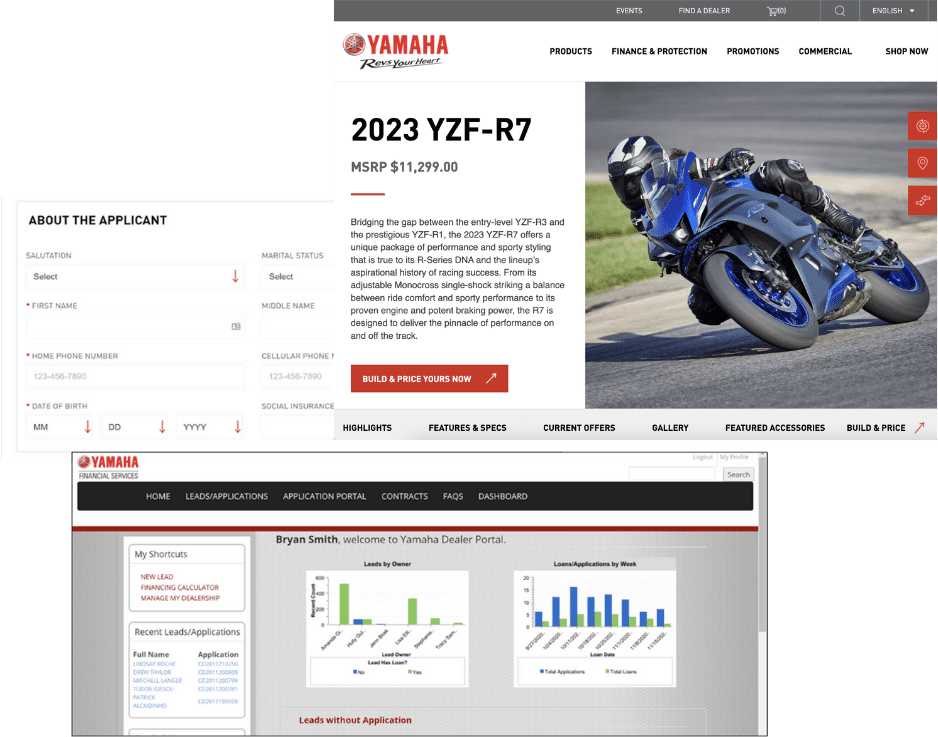

Client Showcase: Yamaha

Increased Book-To-Look Ratio

Book-to-look ratio increased from 12% to nearly 50%

Improved Efficiency

Increase credit decisioning capabilities and capacity up to 300% and decrease credit decision and funding turnaround time

Reduced Risk

Decreased risk exposure with the right key indicators, alerts and integrations with external partners

Bob Metodiev

Head of Business Development

Brendon Aleski

Sales Director