Propel

Attract new customers, and generate more loans from your existing customers, with our industry-leading portal.

Use Cases

Direct financing

Indirect financing

Captive financing

With the Propel, it’s easy to build a seamless vehicle financing application experience directly into your existing digital channels.

Unlock new opportunities for your lending business and deliver added value to existing customers.

Instant Pre-Qualification

Allow consumers to get pre-qualified for financing directly from the portal with integrating credit soft-pull and vehicle valuation.

Seamless Web Experience

Propel integrates into your website as an iframe with single sign-on (SSO) support, delivering a seamless experience to your customers.

Branded Look and Feel

Our customizable front-end with drag-and-drop form creation enables a tailored and fully branded user experience.

How Propel Works

Propel offers best-in-class automations and integrations, and it connects seamlessly with loan management systems.

Explore Propel’s Integrations

E-Signatures

Compliance

Standard Documents

Identity Validation

Credit Bureau (Hard Pull & Soft Pull)

Valuation/Residuals

Communication

A Wide Range of Use Cases

Take advantage of new avenues to accelerate the growth of your lending business.

Direct Financing

Generate financing applications directly from your existing digital channels, driving additional volume and enabling greater flexibility for your customers.

Pre-Qualification Programs

Easily configure workflows without having to file an IT ticket

Refinancing

Unlock additional business from existing customers who have vehicle loans with third-party lenders. Inovatec makes it easy for those customers to refinance their loans with you.

Title Loans

Inovatec Direct Consumer features full support for title loans, opening up another revenue stream by helping you serve price-sensitive customers.

Client Showcase: Yamaha

An end-to-end solution focused on improving the customer journey:

- Propel allows shoppers to apply for financing directly on website, from any product page

- Capture abandoned applications as leads with multi-page forms that allow incremental capture of information

- Propel allows dealers to seamlessly pick up application as either a lead or a fully-approved application

- Full integration with Inovatec LOS & LMS on back-end

- Solution supports any type of asset, including motorcycles, boats, snowmobiles, musical instruments, etc.

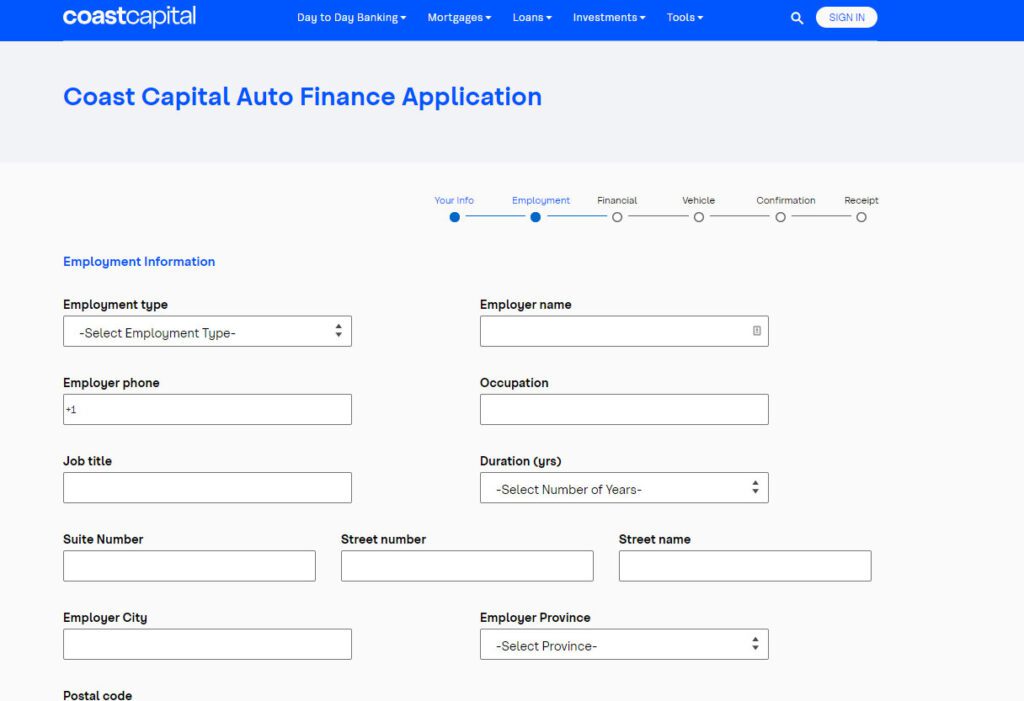

Client Showcase: Coast Capital Credit Union

By deploying our end-to-end solution, Coast Capital grew a direct lending business that doubled the size of auto lending:

- Propel allows customers to apply for car loans conveniently through Coast Capital’s website.

- The integration allowed Coast Capital to double its loan application in the auto lending business without additional marketing efforts.

- Propel seamlessly integrates with the back-end loan origination system (LOS), providing full support for both loans and leases.

Bob Metodiev

Head of Business Development

Brendon Aleski

Head of Strategic Alliances